When are interest rates going to fall? is a question we are asked on an almost daily basis and something that has been in the forefront of most New Zealand borrowers for the past 2 years!

Thankfully, the answer seems to be interest rates will fall soon. A lot of press, globally, is predicting that inflation is beat and interest rates will begin falling in the second half of this year. There is a lot of focus on 3 of the worlds major reserve banks (BOJ, BOE and the Fed) this week to give us further clues as to when those interest rates might fall. Below we explore that in more detail as well as providing some of the key dates to look out for with interest rates.

Abroad

Firstly we thought we would look at the 3 Central Bank announcements abroad, what way they might go and what that might mean for interest rates in New Zealand.

This week there is the Bank of Japan and Fed meetings on Wednesday as well as the Bank of England meeting on Thursday. Dealing with each of these announcements in step.

Bank of Japan (BOJ)

Japan has been chasing inflation for a wee while now continuing to provide stimulus and keeping interest rates low where other nations have tightened their belts. For the third straight month, however, inflation data has risen leading to the expectation that there will be interest rate cuts at this announcement.

The Bank of Japan ended 8 years (EIGHT!) of negative interest rates in March this year as inflation rose and became sustained above their target range. This cooled inflation, however there has been a bit of a bump lately fueling speculation of rate increases.

The belief in interest rate increases at the BOJ as well as possible interest rate cuts (further below) at the Fed has seen a dramatic recovery in the strength of the Yen in recent weeks falling from 161.61 Yen to the USD on the 10th July to 154.04 Yen to the USD today which is a huge drop.

Overall, the market seems to expect that the BOJ will increase their interest rates at this announcement.

Federal Reserve (Fed)

Contrary to the Bank of Japan the expectation with the Federal Reserve (Fed) is that they may cut interest rates or at least pave the way for interest rates to be cut in the September meeting.

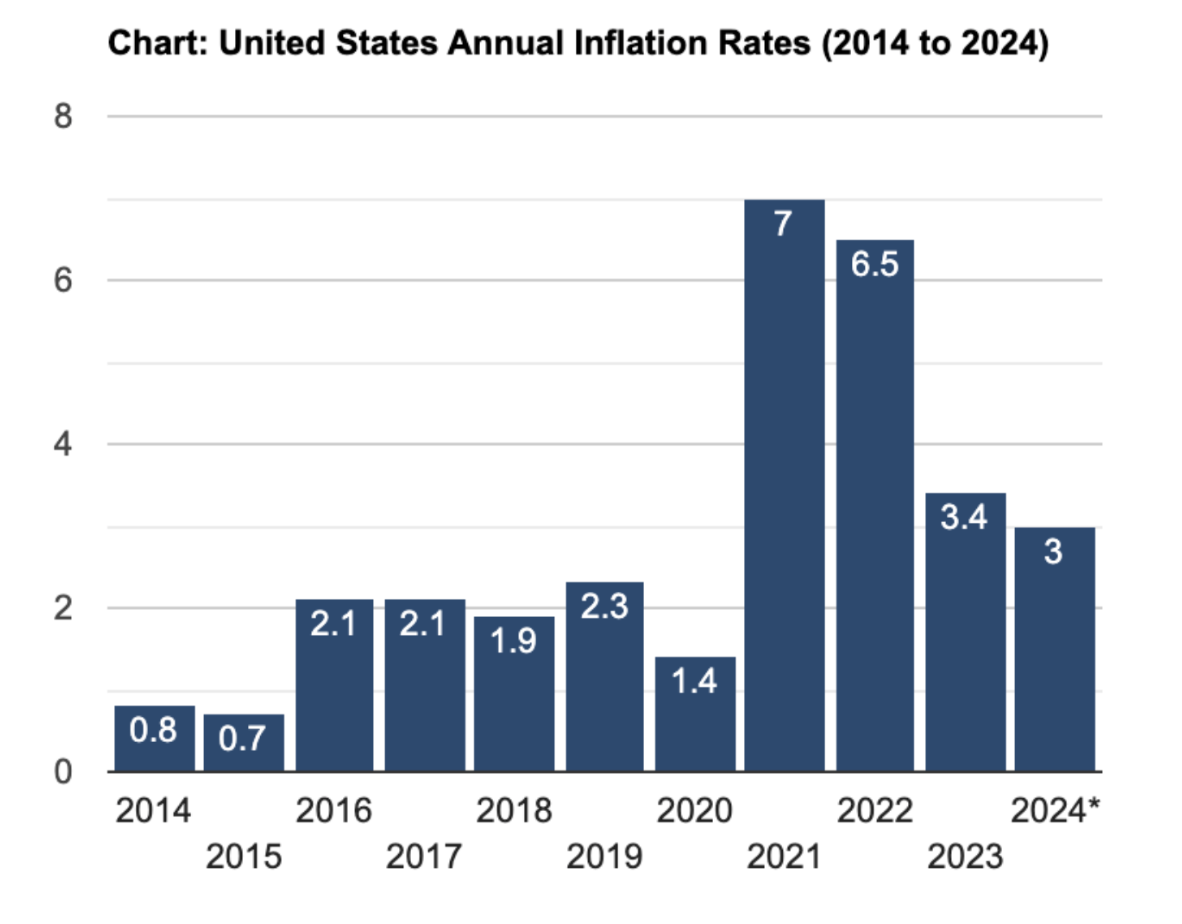

Inflation in the US, similar to New Zealand, has fallen significantly over the last 24+ months and looks to be getting close the targeted inflation rate of 2% or below. Inflation as at June was 3% falling from 3.3% in May.

Similar to New Zealand and other major western nations there has been a big clamour for cuts in interest rates to ease credit conditions for borrowers. The Federal Funds Rate (equivalent to the OCR in New Zealand) is currently at approx. 5.3% which is well above the inflation rate indicating some room for cuts.

Something else that is a consideration for the US, and that I have written about previously here, is the level of national debt the nation has. Current US government debt is sitting at approximately $35 Trillion. A lot of this debt is at shorter term maturities meaning that it will rollover onto current interest rates over the next 12 – 18 months. This will place a lot of pressure on the US government for servicing and likely increase their deficits.

The speculation is that the US will favour some interest rate cuts to ease this burden.

Overall, at this next announcement I am not sure that we will see the Fed cut it’s interest rates, but rather pave the way for cuts in the next quarter.

Bank of England (BOE)

The Bank of England (BOE) is due to make an announcement on Thursday (1 August) this week about the Bank interest rate and the market is split as to whether we will see a rate cut or the current rate being held.

It is likely the BOE will be influenced by the earlier decisions of the Fed and BOJ, however, I would anticipate similar to the other banks they will hold their current interest rate of 5.25% for a further quarter.

The current recorded inflation rate is 2% in England, which is aligned with the target rate and below both Japan and the US, however, I anticipate they will seek some headroom before cutting. Inflation peaked at 11.1% in October 2021 in England, falling sharply thereafter and has sat at 2% for both May and June this year.

Back at Home

Having looked at abroad we turn our attentions to the Reserve Bank of New Zealand (RBNZ) and interest rates at home. As everyone will be aware, there has been a real clamouring for interest rate cuts in New Zealand as we have seen a real struggle with the cost of debt for a lot of New Zealanders and businesses. The mantra, ‘survive to ‘25’ is something I have heard regularly in the last 2 months and suggests most people expect interest rates and market conditions to ease over the second half of this year leading to an easier 2025.

Inflation has fallen sharply in New Zealand in the last 24+ months peaking at 7.3% in June 2022 before falling to 3.3% as at June 2024. The target range for the Reserve Bank of New Zealand (RBNZ) is for inflation to sit between 1% and 3% and therefore we are close to that point.

I suspect that Adrian Orr and the RBNZ will want to see inflation below the 3% high water mark before cutting rates, however, we could see some indications that interest rate cuts are coming as has been some rhetoric lately.

The risk is that persistence high interest rates will begin to have a seriously detrimental effect on the economy prompting high unemployment and a prolonged recession. Whilst it is widely acknowledged that we need a recession to tame inflation and ‘reset’ if you will, there is an apathy toward a prolonged period of troubled economic performance.

I would also suspect the RBNZ will be cautious of the actions of the central banks overseas. Moving ahead of those banks with rate cuts is something I believe the RBNZ will be looking to avoid. Cutting rates would weaken the New Zealand dollar in theory which could prompt some imported inflation (goods cost more as the dollar weakens) and could possibly rattle the apple cart around our target inflation range.

For that reason I think we will continue to hold rates for the time being with some rate cuts possibly in August or October.

Regardless of what the next few months bring we highly recommend you seek some personal advice if you have any rate refixes coming up and the team here at Lateral Partners are here to help you make sense of all the goings on. Reach out for a chat today!

Please read our Disclaimer Statement for more information.