Wow. What a crazy couple of weeks we have had. Rate cuts of 0.75% in the last 6 weeks with further cuts predicted (more on that below) and inflation has come out below estimates and well within the Reserve Bank of New Zealand (RBNZ) targets. Elsewhere Trump has been dancing on stage, Iran and Israel seem to be on the verge of conflict, Germany (Europes largest economy) can’t shake off the economic woes of covid and the Wellington council could face central government intervention!

What does it all mean? Well I think I always knew Trump couldn’t dance but can’t really comment on much other than the recent rate cuts and inflation printout and what we might see to come in the near future.

As widely expected the RBNZ cut again on the 9th of October pulling the OCR back a further 0.50%. The RBNZ issued a statement citing "The Committee agreed that it is appropriate to cut the OCR by 50 basis points to achieve and maintain low and stable inflation, while seeking to avoid unnecessary instability in output, employment, interest rates, and the exchange rate". They also said within their statement that they were confident inflation was within the target range and ‘converging on the 2% midpoint’.

What is interesting is that this decision was prior to the inflation data release and clearly made on other data and surveys. One of the more concerning was data that showed 32% of businesses experiencing worse trading in the September quarter and 41% of businesses experiencing higher input costs while only 3%(!!) felt able to pass those costs onto the consumer.

The RBNZ went so far as to mention in their statement that “Recent business visits suggest that weak demand is restricting the pass-through of increased input costs to prices faced by consumers. This is consistent with business surveys, which show a declining share of businesses intending to increase prices”.

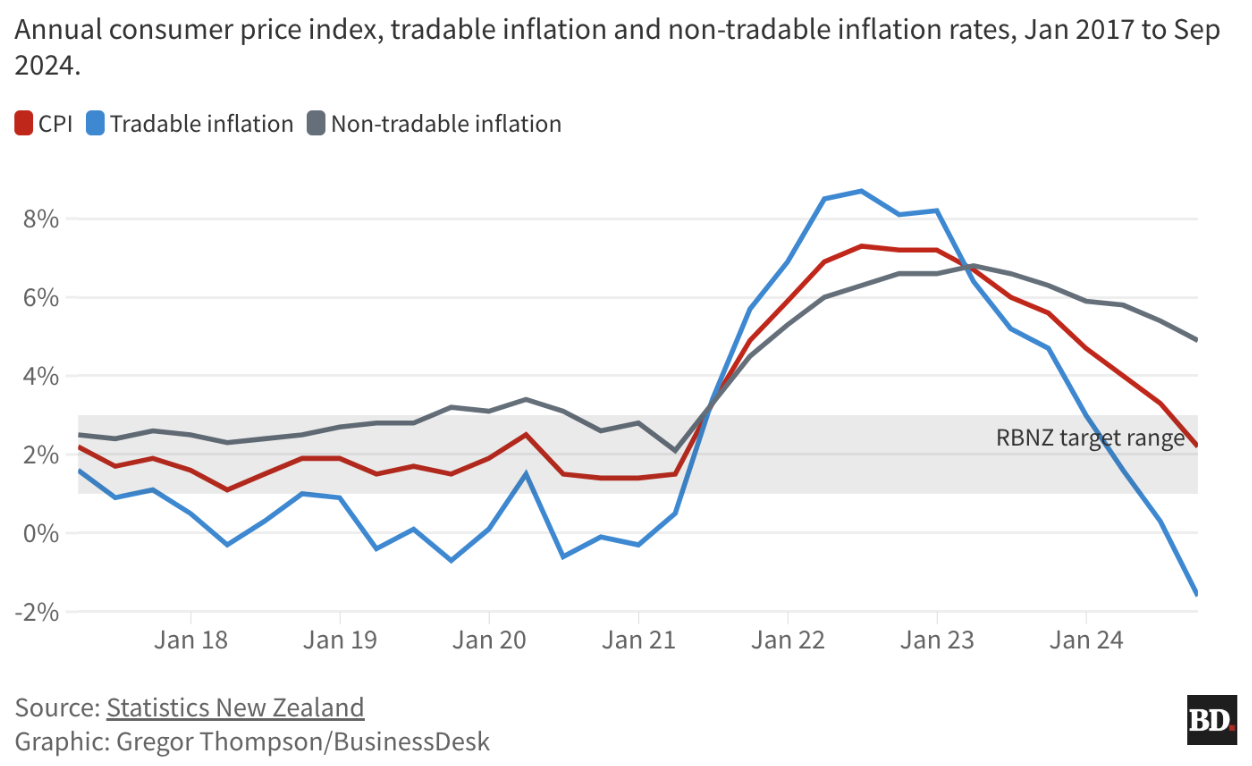

We then saw today that inflation had fallen, settling at 2.2% for the September quarter and within the target range, indeed converging on the 2% midpoint. As a consumer this is good news that we are seeing a slowdown in price increases, however, the devil is in the detail and we look a bit closer at that below.

Tradeable (imported) inflation indeed was negative at -1.6% (falling prices!) whilst non-tradeable (domestic) inflation fell but remained high at 4.9%. Non-tradable inflation was underpinned by Rents, Insurance and Local Authority Rates with rents making up almost 20% of the 2.2% annual increase.

The concern is how sticky non-tradable inflation is as that would suggest it is something we might not be able to reduce early. Rates are set in September each year and there was on average a 12.9% increase following at 9.8% last year. Those who have followed the financial health of New Zealand's local councils and their infrastructure will be acutely aware we are probably going to get another sting next year. I would suggest that whilst inflation has fallen we may be in for a tricky 12 or so months ahead trying to get that non-tradable inflation under control.

It was also interesting to note how few businesses felt able to pass on input cost increases to their clients. In simple terms what this means is that businesses will be seeing their profit margins fall which again, as a consumer, may not necessarily strike as particularly important to yourself. However, lower profit margins does mean that businesses are likely to do 2 things, reduce investment and cut costs. Reducing investment can mean not hiring, purchasing new equipment, vehicles or software. Cutting costs might mean a quieter Christmas party this year or even possibly laying off staff. Both imply that unemployment is likely to increase and might take a while to turn around.

Some now believe unemployment could approach or push beyond 6% against a predicted 5.1% peak. This would continue to put downward pressure on the economy meaning lower consumer sentiment, soft business activity and likely a recession. The recent more aggressive rate cut has eased some of that concern, however, it is lingering with some now pointing to an even more aggressive cut in November.

What is clear is that economically NZ is struggling with many kiwi’s needing a 2nd job to make ends meet whilst unemployment is increasing and borrowing costs remain high. It is important to remember that this latest inflation read just means that prices are increasing at a slower rate, not falling.

We see a good chance the RBNZ will make an aggressive cut in the November meeting dropping the OCR to 4% from 5.5% just 6 weeks ago. This is almost unprecedented (but that word is reserved for covid) and signals that things are pretty tough out there and we should expect things to remain relatively subdued for a while. I expect that, whilst this will improve the affordability of debt, it won’t necessarily spur a big boom in development and house prices. Expect to see marginal property value gains and better trading activity in the next 12 months but for overall economic activity to remain soft. If rates continue to fall in the new year as predicted by many back to a near 3% OCR then we may see this pick up sooner, however, as mentioned above I would be keeping a wary eye on the inflation read.

If you are refixing your mortgage, looking to borrow to buy or even considering a refinance, reach out today. It is a good time to be considering your options to see if you can enjoy the benefits of these rate cuts.

Please read our Disclaimer Statement for more information.