By now most of you would have read articles on the review of Kāinga Ora and some of you may have even read the review yourself. Over the last 3 years, Lateral Partners have secured funding for several developments sold to Kāinga Ora and we spent some time reading the report to get a gauge on what to expect going forward. We explore this and our thoughts below.

The Review

Sir Bill English was commissioned by the incoming government to conduct a review of Kāinga Ora. The review included, amongst other things, ‘the financial viability of Kāinga Ora, Asset procurement and management approaches and institutional arrangements including operating scope, organisational form and structure, governance, and subsidy and funding arrangements that will encourage performance and reduce fiscal impacts on debt and OBEGAL’ (operating balance before gains and losses – effectively this is the difference between revenues and expenses before considering capital gains etc.).

In short there was a lot of focus around the financial viability of Kāinga Ora as well as the general operation of the organisation to ensure it was fit for purpose and suited for longevity.

Those who have read the headlines will have seen that the report itself was rather damming. The report highlighted overleverage, a lack of governance and poor financial controls. Some of the highlights;

- Several mentions that Kāinga Ora is ‘financially unsustainable’ – a big concern.

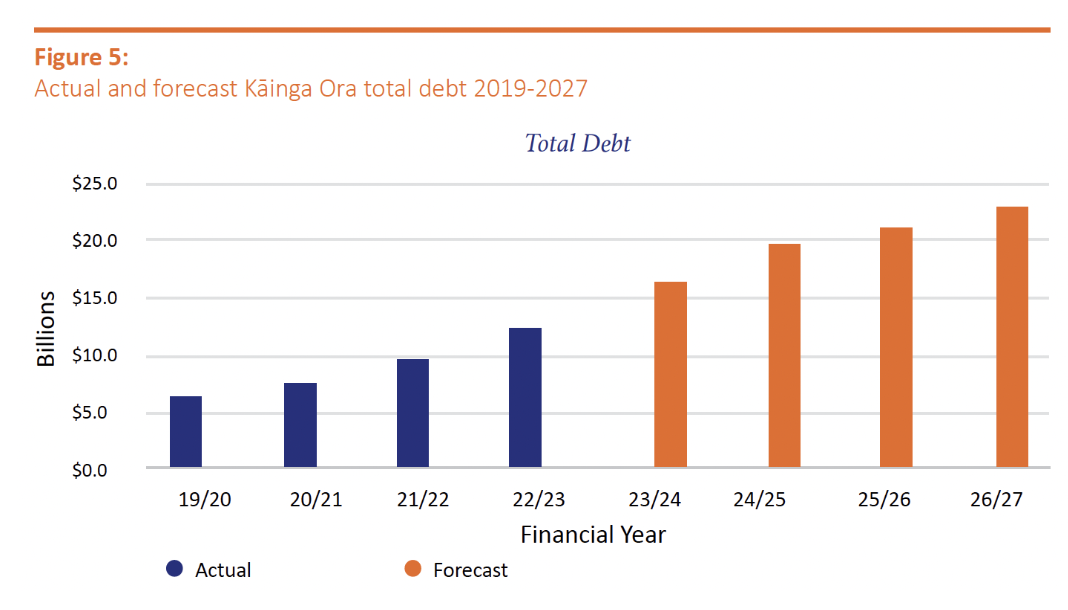

- Enormous growth in debt for the agency from approx. $6bn in 2020 to $12.3bn in 2023. Worse still, this was forecasted to increase to $23bn by 2027.

- Against this increase in debt levels interest payments on debt held by Kāinga Ora has grown from $76 million in 2017 to $310 million in 2023 (an increase of 408%). It is also forecasted to climb to $866 million by 2027!

- Low levels of accountability and poor governance. It was made clear the board were not even reviewing statement of financial position as part of their board meetings!!

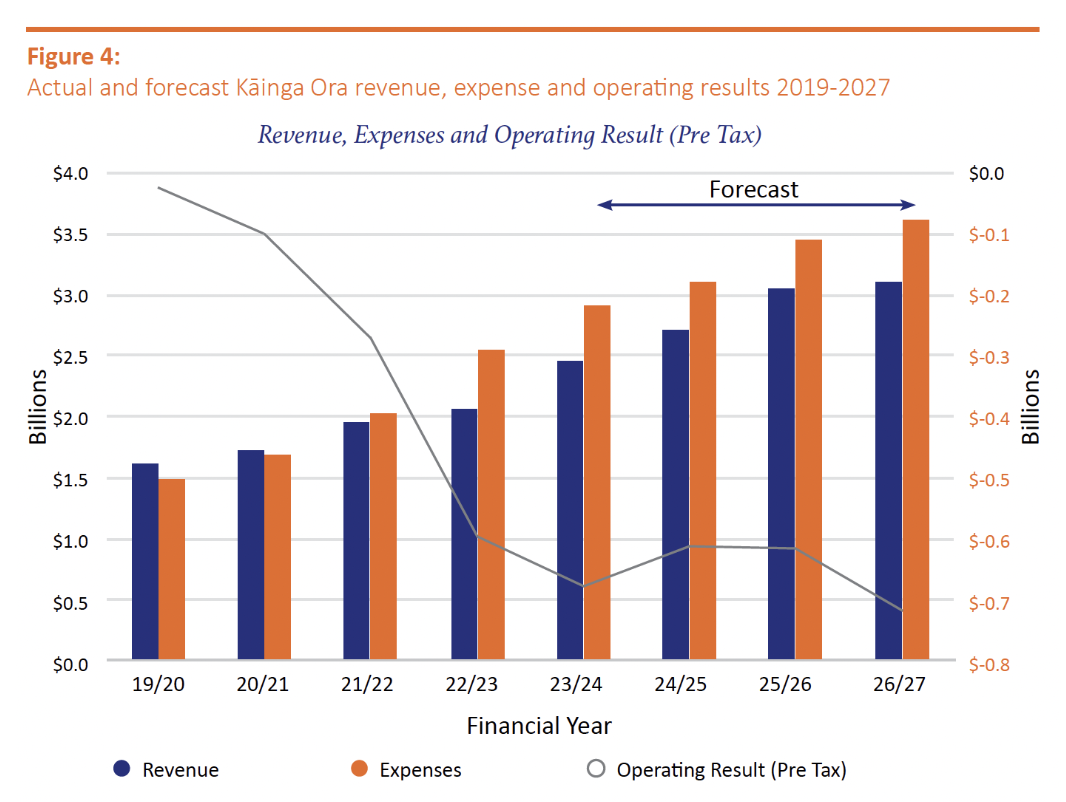

- Large and ongoing annual losses. Operating losses in 2023 were $520 million and forecasted to grow to $700 million by 2027.

- Forecasted cash requirement from the Crown of $21.4 billion over the next 4 years equivalent to $4,000.00 per New Zealander.

- There being a pervasive attitude of good outcomes over and above financial constraints. See comments on the Elm St project below.

Further to the above there were mentions throughout the report where the board itself was being circumvented and the executive teams at Kāinga Ora were speaking directly with ministers effectively undermining any effectiveness the board may be able to bring.

In effect it seems that Kāinga Ora’s ease of access to low cost debt allowed it to pursue rapid growth coupled with a heavy focus on social and environmental outcomes whilst ignoring financial prudence and overall governance.

This is surmised well in an example included within the report on the Elm St development (pg 16). The below is taken from a Kāinga Ora document;

“Whilst at face value the development’s economics are not as attractive as conventional buildings, Elm St is a key development in the Carbon Neutral Housing Pilot. As such it is carrying development costs that are investments in the future, designed to lead the industry to a more sustainable development methodology. These are considered to outweigh the financial performance metrics”.

Despite this lack of financial control and the wilful spending Kāinga Ora were still falling woefully short of their targets. As of January 2024 Kāinga Ora has built or bought 1,690 homes with a target of reaching 4,800 by the end of June (about 35% of it’s target). On average over the last 5 years KO has increased the stock by 1,600 homes well below its target of 4,600.

It should be noted there has been some push back on the report from the previous board, however, this largely seems moot as the report has been provided and supported by the government.

What was the outcome of the review?

In response to their findings the review panel put forward 7 recommendations to the cabinet proposing significant change to both Kāinga Ora and the social housing system in an effort to curb the problems faced.

These comprised;

- Strengthen government accountability for social housing outcomes. Cabinet are to consider consolidating the funding for housing outcomes under the Minister of Housing who will be supported by the Ministry of Housing and Urban Development (MHUD) to administer funding on behalf of the Crown, together with expectations of formal reporting of outcomes by a third party.

This will bring greater transparency and accountability direct to the government opposed to the opaque reporting lines currently.

- To prioritise tenant outcomes and cost-effective provision of housing support and supply, the Minister of Housing directs MHUD to become an active purchaser that takes a social investment approach to cost-effectively improving housing outcomes.

This will ensure that there is a level of financial prudence to the outcomes and that these will be focussed at a tenant level as well. It also loops back to point 1 placing the lead under a single agency (MHUD).

- To better enable tenants and local communities to meet their diverse housing needs and aspirations, government policy and investment builds on the advancements made in place based and specialised approaches to increase local decision making regarding the management and ownership of housing.

The goal here is to push some of the decision making to local agencies and authorities into how and what housing is delivered. This is designed to ensure that the outcomes targeted are fit for purpose and directed by stakeholders best suited to direct them, not parties far removed from the coal face.

- To increase choice, diversity, and innovation, Government enables more providers to participate in the provision of social housing by:

- The purchaser contracting with Kāinga Ora in a similar manner that it does with Community Housing Providers (CHPs).

- Addressing barriers in order to increase provision of social housing by CHPs, Iwi and Maori, and other providers.

- Ensuring the funding model incentivises delivery where needed and is responsive to the different needs to tenants.

- Implementing alternative delivery models based on local decision-making and specific tenant needs, with pathways for communities to manage Kāinga Ora housing stock.

This is an interesting recommendation. It is clearly stating that there is a desire to further support organisations external to Kāinga Ora to enable them to provide housing to their cohorts. It builds on the commentary around tenant outcomes and recommendation 3. We discuss this further in our thoughts below.

The report mentions that part A of this recommendation has been accepted immediately by cabinet and the Minister of Housing has directed MHUD to develop a new contract and initiate negotiations with Kāinga Ora to put it on a more level playing field with CHPs.

- To ensure that Kāinga Ora has the leadership and mandate to effectively implement the recommendations of this Review, responsible Ministers;

- Refresh the Kāinga Ora board with a focus on the skills to implement the recommendations to this Review

- Issue simplified government expectations and direction to Kāinga Ora

- Report back to Cabinet with options to narrow the scope of Kāinga Ora activities to social housing and ensure it has the leadership and governance expertise to deliver effectively, including repealing the Kāinga Ora – Homes and Communities Act 2019 and designating Kāinga Ora as a Crown Company under Schedule 4A of the Public Finance Act 1989 with social and financial objectives.

Part A & B of this recommendation have been accepted and implementation begun. Simon Moutter, former Auckland International Airport and Spark chief executive has been appointed board chairman with further appointments expected for the balance of positions.

Part C is about bringing about further transparency and direction to Kāinga Ora’s objectives by narrowing its scope and bringing it clearly under the umbrella of the government.

- Responsible Ministers set an expectation that the board will develop a credible and detailed plan to improve financial performance with the goal of eliminating losses. The board should be held accountable for implementing this plan through regular reporting to Ministers, supported by on-going engagement between the Kāinga Ora board, Kāinga Ora management and HUD.

This recommendation has also been accepted by government with implementation underway, including;

- An updated Letter of Expectations is being drafted to go to the refreshed board.

- A reduction in the delegation to the Board for individual investment decisions to $35 million (from $50 million).

The Minister of Housing has also requested a plan from the Board to develop a credible and detailed plan by November this year to improve the fiscal performance with a goal of eliminating losses as quickly as possible and present choices regarding the renewal programme of aged assets including pace, scale and procurement approaches.

- To generate momentum toward the recommendation the Panel has suggested the following timeframes for key milestones;

This is self explanatory and the cabinet has accepted these milestones.

So what do these mean?

Per the above, 4 of these recommendations were immediately accepted namely the appointment of a new board, alignment with CHP’s, requirement for the new board to deliver a plan for Kāinga Ora and the key milestones above.

We consider the most interesting detail to pull out of the report is that it appears, aligned with Nationals Housing Policy, CHPs and other community organisations will be better enabled to deliver housing outcomes with the playing field being levelled with Kāinga Ora. This is a sector that has grown significantly in recent years, but unlike Kāinga Ora seems to be maintaining operational surpluses and achieving better outcomes.

We recently produced a blog on developing build to rent’s for CHP’s here.

Despite this, Kāinga Ora will also continue (and needs to continue) to deliver housing to New Zealand. The form of this will be interesting, however, it wasn’t missed in the report that acquisitions seemed to be performing better than internal delivery. We may see a shift toward private market delivery of housing.

We don’t anticipate large scale sales of housing assets to private entities but likely some retrenchment of internal delivery and a narrowing of focus and function.

We expect to see detail released from the government towards the end of this year (post November) that will give some direction to where Kāinga Ora and wider housing support is heading. We expect it will reduce Kāinga Ora’s reach and likely place a wider focus on private delivery and acquisitions as opposed to internal delivery. We also anticipate that the CHPs and other similar organisations will begin to take a wider role in the process.

The downside here is likely that there will be consultants, builders and other private organisations that suffer greatly from reduced forward work. You will also likely see staffing levels at Kāinga Ora shrink substantially, particularly if there is a retrenchment in acquisition or internal delivery of housing. This is already being contemplated and has been seen across several organisations as the government as a whole pulls back on spending.

If you have any questions - talk to us today!

Please read our Disclaimer Statement for more information.