Are you a building company owner looking to venture into the spec build space but unsure where to start with funding? This blog will cover everything you need to know to get your first project off the ground and scale up efficiently.

Land Acquisition

When it comes to land acquisition many spec build clients will obtain sites from proposed subdivisions which may contain conditions such as the below:

- Lowest price – an acknowledgement that the purchase price set is the lowest the vendor could offer and does not contain any provision for interest on an extended settlement.

- Extended settlement date – may be set at 12 months to allow for future planning and scheduling if the purchaser has multiple spec build projects in the pipeline/on the go. This also increases possibility of value uplift at time of settlement unlocking instant usable equity for the build.

- Settlement upon issuance of Building Consent – may be set as a separate condition or set alongside the settlement date as a whichever occurs first provision. Allows the developer/builder to get underway with their construction program as soon as consent is issued.

The above conditions can prevent the need to obtain funding twice – once for land acquisition and again for construction saving on holding costs, particularly if there is a significant time gap between the two for design/consenting etc. It’s important to work with a lawyer familiar with these types of contracts to ensure you are structuring the contract in the most efficient manner for yourself and your business.

When seeking finance for the land acquisition and construction programme all in one, the first drawdown will normally be at a maximum of 50% of the land value (including lender and broker fees) and the remaining 50% will have to be bridged with cash or additional equity.

Some land developers will also offer builders terms on section purchasers. Builders terms normally relates to allowing the builder early access to the site to develop prior to settling the property. This is great as the builder can add value to the property prior to settlement allowing for possible additional leverage on settlement as the project is progressed and it isn’t just vacant land at acquisition. It also manages your capital outflows as you only need to fund construction initially rather than both that and land settlement.

That all sounds great, however, it is important to confirm that those works on site cannot be funded directly as there is not a mortgage available for the funder given the builder hasn’t actually settled on the section. The ownership of the property is retained by the land developer until settlement preventing this. These works can, however, be funded with cash or leverage against another property held within the group.

It is important to note, if you did build on the property and subsequently fail to settle on the property when required that you will forfeit the work completed on the property. It is imperative to be sure of your ability to settle on the section.

Construction Cost Thresholds and m2 Rates

When seeking funding for spec build projects as both the builder and sponsor, the sponsors estimated square metre rates are often significantly lower than market rates which is to be expected due to strong supplier and subtrade relationships, bulk order capability, removal of builder’s margin and at times labour being self-managed.

This is standard and expected for these types of transactions however, an important factor a lender must consider when assessing the risk of the proposed transaction, is the event of the builder falling over and the lender having to take over management of the project to complete the build, sell and recuperate their capital. If this was to occur, the lender would likely be unable to complete the build for the original cost estimated by the sponsor of the project due to not holding the same relationships, supplier agreements etc mentioned above.

To mitigate this risk the lender will often adopt a higher square metre rate which presents some challenges but also can benefit the sponsor (more on this in the next paragraph). This way the lender can be confident if the builder fell over, the lender would be able to contract the completion of the project to recuperate their capital without having to over-leverage the project. Alternatively, if adopting a lower square metre rate, the lender may allocate a higher contingency to mitigate against the risk of construction costs overruns or the risks that present with working off lower than market build rates.

To note, as you may have picked up, adopting a higher square metre rate will increase the perceived cost of the project. This may mean that the borrower is required to put additional equity into the transaction as lenders will fund on a cost to complete basis and thus require the sponsors equity in before their funding will release.

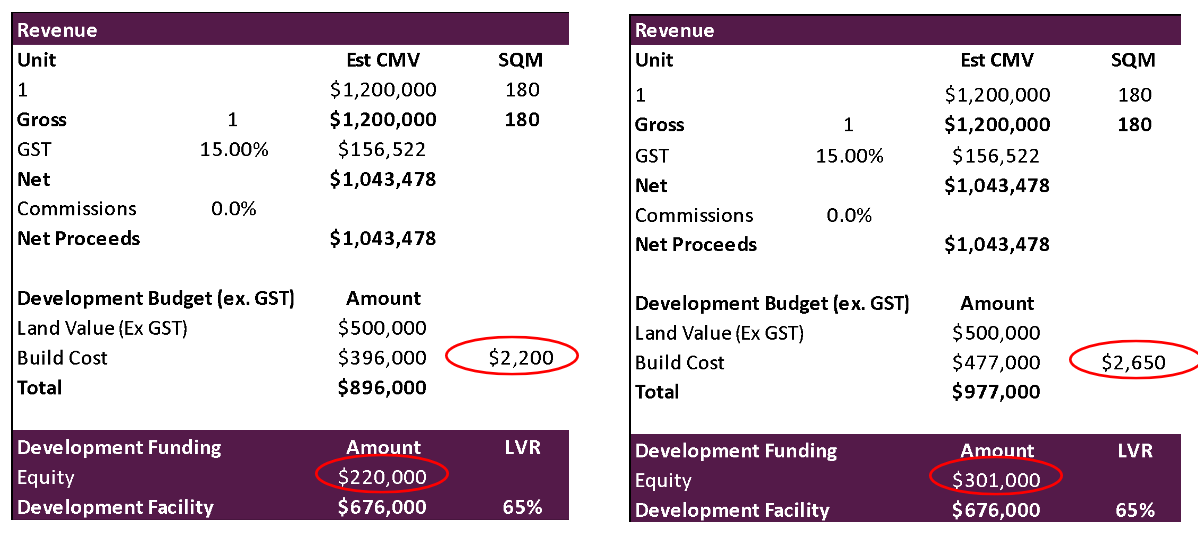

An example of this is shown below:

Releasing Equity Through the Project

In projects where the margin and leverage allow, we often allow for a higher square metre rate for construction costs in the funding application to reduce the risk to the lender (as mentioned in the previous paragraph), but also to release available equity back to the sponsor throughout the project.

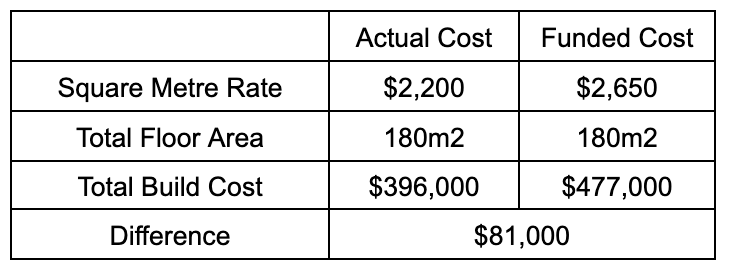

An example of this is shown below:

In this case the $81,000 can be released progressively throughout the project as milestones are hit and can be utilised as additional contingency, management fees or working capital etc.

Choosing a Lender

Choosing the right lender for your spec build projects is not only important from a pricing/cost perspective but also from a relationship building perspective. There is a lot to be said in curating a strong lender relationship through repeated spec build transactions with the funder in creating a strong brand for yourself of repayment history, running on time and to budget, being able to move stock along etc. However, if you have multiple projects on the go putting all of your eggs in one basket can create additional risk with any change in credit policy/risk appetite etc affecting all of your projects in which case it would make sense to diversify across a few lenders to help mitigate this.

It’s also important to have an ear on the ground when it comes to the finance market in New Zealand as lender appetites can change with short notice depending on their lending portfolio at the time as well as new financiers that may already be well established offshore may launch in the New Zealand market at competitive terms and rates. There are plenty of finance options out there on the market (we have 120+ on our panel) and it’s important to be matched with the right one for your project to maximise efficiency and profitability.

When considering the duration of the loan term it’s important to factor in additional time for selling on completion if unable to obtain a sale before or during the commencement of the build – there is the option of refinancing onto an investment facility for residual stock at likely lower interest rates, however, if you anticipate selling down 2-3 months for example after completion it could be more cost effective to request a longer loan term up front as refinancing for a short term would attract additional lender fees costing higher than the extra 2-3 months of accrued interest.

Your adviser is an expert with all of this and therefore we highly recommend reaching out to them early in the process when considering a spec build.

Leverage & Finance Costs

Typically, lenders will lend up to 65% LVR (on completion value) including fees and interest for spec builds located in main centres. For regional builds this will sit slightly lower so a higher equity contribution would be required, and you may also be slightly more constrained with available lenders. Lateral Partners have sourced funding for spec builds both in main centres and regionally so there are still plenty of finance solutions available in this space no matter the location.

When it comes to interest costs there are two options depending on what your cashflow allows for – capitalised interest & serviced interest.

Capitalising interest and fees mean these costs get added to the loan amount and are only paid once the loan is repaid. To note, the interest and fees charge is incurred when they are due, they are just accrued against the loan and repaid on completion and repayment of the loan. The benefit of capitalising these costs is it greatly helps assist with cashflow management as you don’t have repayments coming out of your own pocket each month allowing your cash to be deployed elsewhere. The downfall however being that you would end up paying more interest over the term of the loan than you would if it was serviced due to the costs accruing and paying interest on the interest that has accrued.

Serviced interest is exactly what it sounds like - making monthly interest repayments in accordance with the balance of the loan. This can be a preferable option in terms of managing the overall finance cost, but also helps increase the amount of capital available for the direct project costs. When these costs are capitalised, they form part of the loan facility limit and therefore are allocated from the loan meaning less for construction costs. Whereas when the interest costs are instead serviced, they are not added to the loan and therefore a higher level of construction costs could be covered by the facility. The difficulty with this arrangement is it requires the available income to meet the monthly interest payments.

How much will spec build finance cost can become a ‘how long is a piece of string’ question as it does depend on the individual project, sponsor, location and the finance solution required. A blog we have recently written on development finance costs has been linked here - although this was written with larger developments in mind, it is still relevant for spec build finance as it discusses common fee structures and progressive drawdown structures – note these are capitalised interest examples.

As mentioned above, speaking with your adviser should give you a good idea of what it might cost and if you have an offer but are unsure on how much it will cost on a dollar basis check out our calculator here!

Information to include in application

While information around the subject site/location are fundamental, there’s also other important information to be included when applying for spec build finance.

Firstly, it’s important to detail information around your own experience – any trade qualifications held, previous project management work, length of time in the construction industry etc.

Secondly, covering off previous projects with specific addresses included is greatly beneficial for multiple reasons which are listed below:

- Accurate cost estimation – listing out previous similar builds of a similar spec showcases that you have practical examples to use when estimating costings for your next project.

- Location familiarity– listing previous projects completed in a similar location can help showcase you are familiar with the area and have realistic and accurate expectations when it comes to estimating the value on completion/sale price and therefore your anticipated profit margin

- Consistent delivery – including timelines of your previous projects completed can help showcase you have a strong track record of delivering your projects consistently on time and therefore reducing the risk to the lender of having to extend the facility beyond the original term and therefore incurring additional costs to the project reducing the margin and profitability.

- Sales history – when listing out previous projects completed including details around which ones have sold and detailing whether they were pre sold before construction, sold during construction, or sold on completion helps demonstrate to the lender that you are building a product that is in demand to the market (effectively demonstrates market acceptance), can market your product effectively and are listing at a realistic and achievable price level reducing the risk to the lender that once construction is completed the stock is unable to be moved on and has to be moved to a residual stock facility or extend the current facility (which again can incur more finance costs/fees and reduce profitability of the project).

Thirdly, providing a feasibility for the project is essential for the lender. Our feasibility guide and template has been linked here to show you how to do this.

By understanding these key aspects of spec build finance, you can better position your building company to successfully navigate funding, start your projects and scale up efficiently.

If you would like some help in obtaining funding for your spec build projects, reach out today.

Please read our Disclaimer Statement for more information.