When working with property developers on funding options for a development project this is a question we are asked all the time and not something easily answered. As a rule of thumb we suggest clients allow 8 – 10% of the total development facility for finance costs (i.e. $240,000.00 - $300,000.00 for a $3,000,000.00 facility) on a development project.

The reason it isn’t easily answered how much development finance will cost you is quite simply because there are so many different development lenders with different interest and fee structures. We have attempted below to firstly explain what these fees are and how they work and then secondly how much it might cost you.

Definitions

Interest Rate

Let’s start with something simple, your interest rate. Quite simply this is the rate at which you are charged interest on any outstanding balance. What is important to understand is that it is only the outstanding amount you should be charged interest on, not the approved limit.

You, therefore, cannot simply multiply the facility limit by the interest rate to get your interest costs as that will grossly overstate the amount given you are only drawing the loan down as you require the funds.

For example, if your interest rate were 10% and you had $500,000.00 outstanding on your loan over a 31 day month then your interest bill would be 10% x $500,000.00 x 31 days / 365 days = $4,246.57 for that month. If that balance then went up to $750,000.00 for the next month the interest bill for that month would be $6,369.86 (assuming another 31 days). If you had a $3,000,000.00 limit and had just multiplied that by 10% you would be accounting for an interest bill of $25,000.00 per month well above what it will be over most months.

We typically assume a ‘utilisation rate’ of 65% on a development loan which is another way of saying we expect the loan to, on average, have 65% of the total limit owing over the course of the term rather than trying to estimate the month-by-month loan balances looking forward. For example, a $3,000,000.00 loan we would expect to have on average $1,950,000.00 outstanding ($3,000,000.00 x 65%). We then multiply this by the 10% to get the annual interest cost ($195,000.00).

It may be crude but is a close representation to what you will be paying without a detailed cash flow being completed.

Establishment Fee

This is a one-off fee charged by a development lender on drawdown of the development loan. As development lending is short term (typically no more than 12 – 18 months) development lenders require a fee structure to ensure they secure an adequate return for their commitment of funds.

The size of this fee will vary between lenders and may go up or down depending on your loan term. Typically, development lenders will chase an annual rate of return so loans less than one year may attract a lower fee and vice versa, loans of more than 1 year may attract a higher fee.

Line Fee

This is an ongoing monthly cost attributed to the facility limit. As we mentioned earlier, a development loan will be progressively drawn over the course of the facility. Despite this, most development lenders will set aside funds for that loan to ensure they are able to make all drawdowns. A line fee is a consideration for these funds being set aside but unutilised. It is a monthly fee charged against the full facility limit that provides a return to the lender despite these funds remaining partially undrawn. Important to note here that it is charged against the full facility limit despite whether the funds are drawn or not, it is therefore NOT an unutilised cost.

Line fee’s are often quoted as their monthly cost (i.e. 0.10% or 0.25%) so it is important that you make the adjustment to the total term of your loan to accurately establish the full dollar cost. For example, a 0.25% Line Fee per month is 3.0% per annum.

Monthly Management Fees

This is a monthly fee charged by development lenders typically associated with the cost of managing a loan. What does this mean? Well that is a valid question.

A lot of non-bank development lenders will be based in Auckland for example but perhaps lend outside of the Auckland region. Part of their requirement to their investors may be that they attend regular PCG meetings and site visits amongst other items which could involve travel and other costs. The management fee is a consideration of this.

These are, where applicable, typically a small cost of $150 - $300 per month.

Legal Fees

One thing often missed with development finance is that the client will often pay for the lenders legal fees (including banks). This cost can be onerous depending on the complexity of the transaction.

Each lender will have different solicitor firms they prefer to use and we always recommend the client get more than one quote for these costs to determine the best option for them.

It is hard to quote exactly what these costs will be but can range from $4,000.00 + GST through to $25,000.00 + GST and up. The cost will vary depending on a number of things including;

If a pre-sale review is required.

If there are any other counterparties that need to sign (i.e. a mezzanine financier).

If the loan documents are negotiated between your solicitor and the lenders.

Effectively, the more time that a solicitor has to spend on a transaction the more it will cost. Most transactions fall under $10,000.00 however and a simple development project will cost somewhere around $6,000.00 + GST.

Other

There are a number of other costs that may be affiliated with your finance. These aren’t necessarily directly finance costs but rather items you may require to secure for your finance. The two most pertinent examples of these are the need for a Valuation and/or a Quantity Surveyor (QS).

Most development lenders will require one or both and they can be costly. As with legals there is no fixed cost of these, and they can vary depending on the complexity of the transaction. There are also situations where securing these are of value to the developer themselves and therefore shouldn’t just be seen as something to avoid if possible.

A valuation for a typical small – mid sized development project should cost somewhere in the range of $5,000.00 - $10,000.00.

A QS will cost $5,000.00 to $10,000.00 for the initial report and then a further $1,500.00 - $3,000.00 for the monthly drawdowns for your typical small - mid sized project giving a total cost of approx. $30,000.00 - $45,000.00.

Broker Fee

Lastly, our fee.

As Development Finance is an unregulated form of finance development lenders do not pay commissions to brokers. There may be instances where we are paid directly from the lender, however, this fee is included then within their finance rate and determined by us. It is in effect our fee.

The fee is a consideration for the time and work involved in preparing the application, advising you as the client, dealing with the development lender and securing the finance. At Lateral Partners we also remain engaged throughout the development project and will touch base to ensure things are tracking smoothly even looking to attend PCG meetings where applicable.

Typically the broker fee is charged on drawdown of the loan, it is therefore a success based fee. There are, however, instances when this may be partially bought forward to the point we are engaged. This is more often occasions where we are aware that there are other parties engaged in securing finance and therefore we will look to charge a small amount to cover our time that is then netted off the establishment fee if you proceed with an offer we provide.

How Much will it cost?

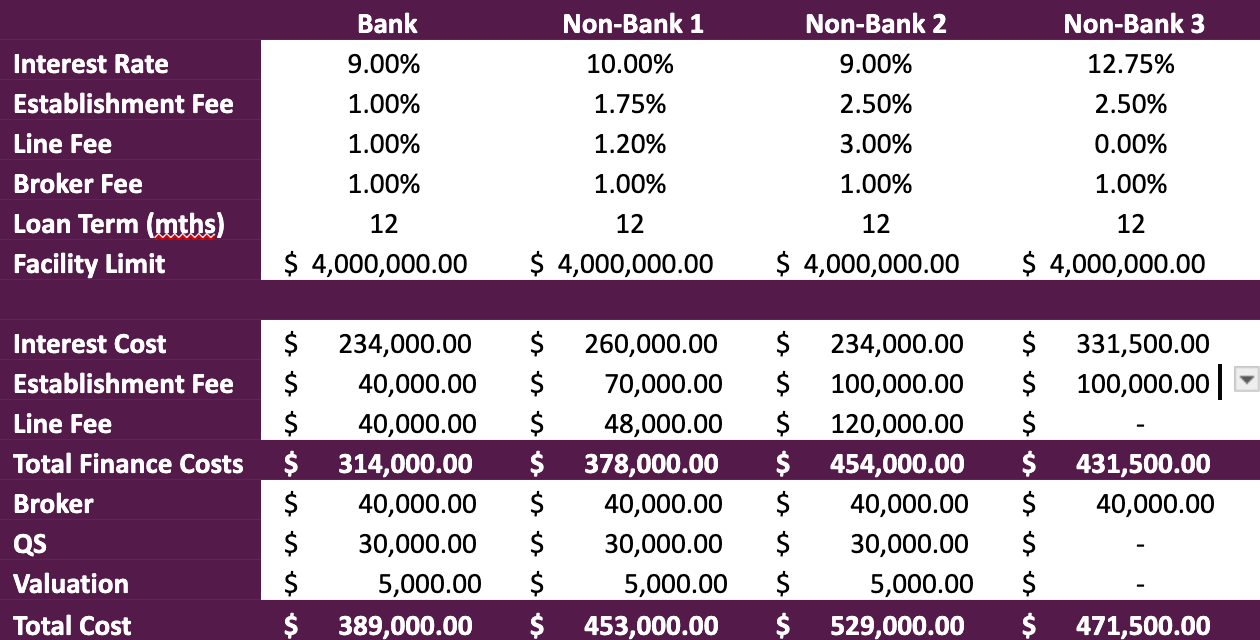

Now that we have provided a brief definition of the costs, let’s get to how much it might cost you. Below we have put a table together detailing 4 different finance structures to give you some idea as to what the cost might be. It is important to note that this will vary for each loan but the below is real examples of recent pricing we have received. Note, for the sake of making the comparison easy we have assumed the same facility limit for each lender, this may not be the case when looking at a bank vs a non-bank option.

As you will intuitively know, development finance from a main tier bank will be cheaper than a non-bank lender. This is detailed above, what is interesting, however, is how the total costs can stack up between the non-bank lenders depending on their pricing structures.

Overall, the total cost on a $4,000,000.00 loan ranges from $389,000.00 through to almost $530,000.00. It also shows that the gap can widen significantly when considering some of those other costs.

Hopefully the above has given you some direction to how much a development loan might cost you.

As always reach out if you have a project and need some help.

Please read our Disclaimer Statement for more information.